Iranian vehicles market has collapsed after all imports have been stopped and high inflation and economic crisis dropped down the domestic demand. Following the already sharp -35% reported in the previous year, in 2019 sales dropped 45.1%.

Economic Environment

Iran’s economy darkened in recent weeks, as tensions with the U.S. rose following the U.S. assassination of Major General Qasem Soleimani and retaliatory missile strikes by Iran. This has generated further economic uncertainty, led to fresh U.S. sanctions, and raised the prospect of more conflict going forward, likely weighing on business sentiment.

Meanwhile, crude oil production continued to contract at an alarming rate in December, suggesting the energy sector remained in the doldrums.

Moreover, still-high inflation continues to hamper consumers’ purchasing power. On a brighter note, domestic activity likely benefited from a dip in the unemployment rate in June–September, and solid steel production.

Industry Outlook

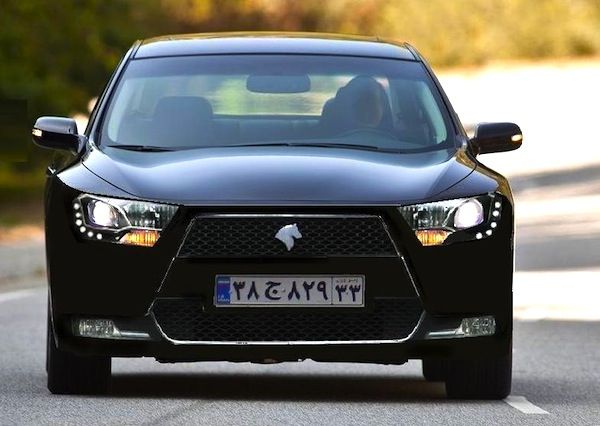

The Iranian market is the largest in middle east with a powerful – but quite obsolete – local production and imports for all the international brand.

The industry – as many others sectors – life under the influence of international relations and the long dispute with US related to the potential local built of nuclear weapons has isolated the country.

In the last decade, when the domestic market was around 1.5 million units (and within the top 15 in the World) the introduction of US sanctions closed the doors to products and parts to the sector, hitting the production and the sales of French products (Peugeot and Renault) always very strong in Iran in partnership with local producer.

In the 2013 the market hit a negative peak of 784.000 sales limiting the lost thanks to the fast development of Chinese brands, which partially covered the open spaces left by French carmakers. When sanctions had been stopped (2014) the re-start of production for Peugeot and Renault and the arrival of parts for local brands revamped the market, which grew up for four years in a row with 2017 sales at 1.34 million.

Unfortunately, the Trump’s election has generated new sanctions and despite EU was not aligned with US decision, all Car Manufacturers were “forced” to break any plans in the country. Peugeot was quite ahead in the plan to base Iran as production hub for EMEA region while Volkswagen was near to open local facilities when all projects have been stopped.

Market Trend

As anticipated, following the recovery reported between the 2014 and the 2017, when sales doubled at 1.3 million annual units, since the 2018 the market approached a new declining pathway.

According to data released by the Iranian National Bureau of Statistics, in the 2018 light vehicles sales (local production plus import) were 1.194.505, with a drop of 23.1% and the trend further deteriorated in the 2019, when all import stopped.

In 2019 the market registered a huge sales’ drop. Indeed, the market almost halved its sales, registering 655.515 units, down 45.1%.

Brand-wise, the market leader was Saipa with sales near to 0.22 million units, losing 35.4% of volume and holding over one-third of total market.

In second place there was Peugeot (indeed, we consider Peugeot the models, like the Peugeot 206, produced on French maker licence by the local manufacturers, while PSA stopped to consolidate the Iran activities within their global figures) with 209.844sales (-37.6%) and in third Iran Khodro with 93.45o units (-25.5%).

Tables with sales figures

In the tables below we report sales for Top Brands