France auto market in 2020 falls by 25.5% as the pandemic and lockdowns affect sales. Full-Year sales have been 1.65 Million, the lowest annual volume since 1975. EU and government incentives boost AFV sales significantly.

Market trend

The French car market was hit extremely harshly in 2020 as the global pandemic has impacted sales tremendously. In fact, the fall was so harsh that we recorded the lowest annual volume for the country since 1975.

The market was in a positive momentum since early 2015 and the Macron government’s active policy has corroborated the market pushing up consumer confidence and expectations.

Consequently, the car passenger sales level achieved in 2019 was the best in the decade and followed 6 years of consecutive growth, with 2.21 million units sold, up 1.9%.

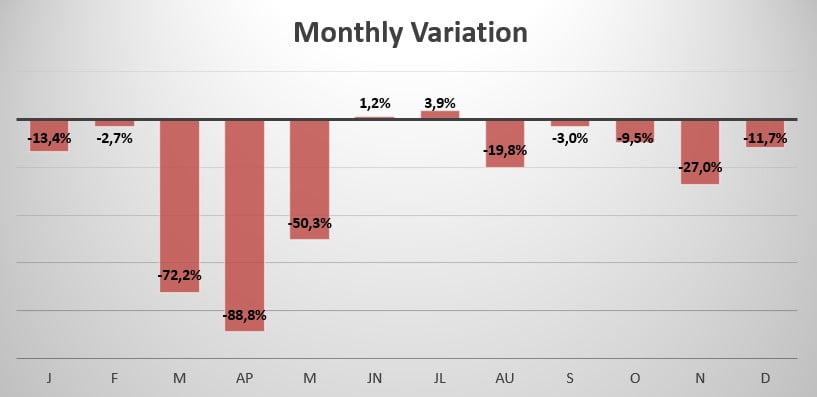

After starting the year with a slight negative trend (-13.4%), the market quickly collapsed in March as the virus struck. The sharpest drop in sales this year was in April when sales declined by 88.8% as the entire country was put in a complete lockdown. Thanks to EU and French government incentives the market recovered extremely quickly in June (+1.2%).

In fact, president Emmanuel Macron announced an €8 billion plan to support the French car industry and sustain the country’s economy from the Covid-19 crisis. The plan includes subsidies for the purchase of “clean” vehicles – up to €7.000 for electric cars – while fostering clean technology development. Nevertheless, the market has been struggling since August.

Indeed, Full-Year sales for 2020 have been 1.650.197, reporting a decline of 25.5% compared to 2019.

Due to the government and EU incentives HEV is up 58.2% to 169.064 and 10.3% share vs. 4.9 in 2019, BEV soars 159.4% to 110.912 and 6.7% share vs. just 1.9% last year and PHEV surges 301.2% to 74.587 and 4.5% share vs. 0.8%. In contrast, petrol sales freefall -39.6% to 773.363 and 46.9% share vs. 57.9% in 2019 and diesel registrations drop -33.3% to 504.191 and 30.6% share vs. 34.1%.

Brand-wise, this year the leader Renault (-22.7%) gained 0.7% market share, followed by the growing Peugeot (-20.5%), which gained an impressive 1.2% share. Citroen on the other hand lost 0.7% share, falling 30.8%. Volkswagen remained in 4th place despite reporting the worst performance in the leaderboard (-34.4%), followed by Dacia which lost 30.1%.

Toyota registered the best performance in the leaderboard by losing only 11.8%, followed by Ford (-30%) and Mercedes which jumped 1 spot and lost 25.1% sales. Closing the leaderboard we have BMW -up 2 spots- losing 22.6% this year and Audi entering the leaderboard by jumping 2 spots, losing 21.2%.

The most sold vehicle this year has been the Renault Clio (+19.4%) with 95.637 units sold and jumped 2 spots, overtaking its archenemy the Peugeot 208, which lost 9.5% registering 95.514 new sales this year. The Peugeot 2008 (+8.4%) closes the podium by jumping 4 spots and reports 66.927 new units sold.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 Models.