Indonesian vehicles market in 2020 falls by 46.1% as the pandemic and lockdowns affect sales tremendously. Full-Year sales have been 582.298, the lowest annual volume since 2009. Nissan (+5.6%) is the only brand on the leaderboard to report growth.

Market Trend

The Indonesian car market was hit extremely harshly in 2020 as the global pandemic has impacted sales tremendously. In fact, the fall was so harsh that we recorded the lowest annual volume for the country since 2009.

The market had spent four years in the sky, when, during 2010-2013 the market scored four all-time records in a row, almost doubling volume and not only outpacing the magic 1 million units quota but landing at a 2013 record of 1.22 million vehicles sales, before interrupting the run in 2015 with registrations at 1.031.808 (-14.5%).

Then a new positive pathway was taken ending 2016 at 1.074.000 units (including HCVs and Bus) and keeping a moderate recovery in 2017 as well. In 2018, the market was substantially flat, ending with 1.140.349 units sold. In 2019, the market registered a negative trend, with full-year sales at 1.079.474 (-5.3%).

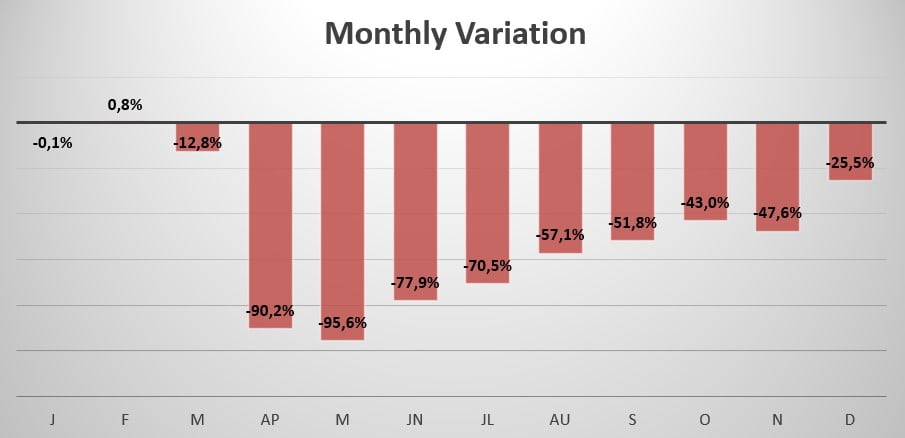

After starting the year flat (-0.1%) the market registered the only positive month of the year in February (+0.8%). The market started falling in March as the virus struck, in fact, the sharpest drop in sales this year was in May when sales declined by 95.6%. In the following months, the market remained down in double-digits for the entire rest of the year, recovering very slowly.

Indeed, Full-Year sales for 2020 have been 582.298, reporting a decline of 46.1% compared to 2019.

Brand-wise, this year the leader Toyota (-46.5%) lost 0.7% market share, followed by Daihatsu (-47%), which lost 0.5% share. Honda lost 0.9% share by falling 48.4%, while Suzuki reached 4th place and reported a loss of 24.9%, followed by Mitsubishi which lost 49.3%.

Mitsubishi Fuso lost 59.9%, followed by Isuzu (-29.5%) and Hino which reported the worst performance on the leaderboard by losing 60.1%. Closing the leaderboard we have Nissan reporting the best performance on the leaderboard this year by growing 5.6% overtaking Wuling, which lost 51%.

The most sold vehicle this year is the Honda Brio (-41.9%) with 40.879 units sold, followed by the Suzuki Carry Pick Up, which lost 34.1% registering 38.072 new sales this year. The Toyota Avanza (-58.6%) closes the podium and reports 35.754 new units sold.

Tables with sales figures

In the tables below we report sales for top 10 Brands, top 10 Manufacturers Group and top 10 Models.