Mexico car market in 2020 falls by 28% as the pandemic and restrictions affect sales. Full-Year sales have been 949.121, the lowest level since 2011. Ford reports the worst performance on the leaderboard by losing 35.4%.

Market Trend

The Mexican car market was hit extremely harshly in 2020 as the global pandemic has impacted sales tremendously. In fact, the fall was so harsh that we recorded the lowest annual volume for the country since 2011.

The Mexican automotive industry grew up uninterruptedly for the entire period 2010-2016 with light vehicles sales booming from 803.222 (2010) to the all-time record of 1.604.000 (2016) and the growth of the domestic market was simultaneous to the huge development of the local production, which boomed for new localization done by new manufacturers like Honda, Mazda, Hyundai, Kia and by the expansion of already existing companies, like Ford and General Motors.

In 2016 Mr. Trump became President of the United States. The Mexican domestic market was at a high peak and it was expected a steady decline before starting a new positive path and indeed in 2017 sales declined just 5% at 1.53 million.

However, the start of the revision of the commercial agreement with the US and the increase of tariffs blocked the growth of the Mexican economy and the major industrial sector, the automotive was even more penalized by new limits to the export to the US zone. The negative trend became more “structural” than expected and sales declined in 2018 and 2019.

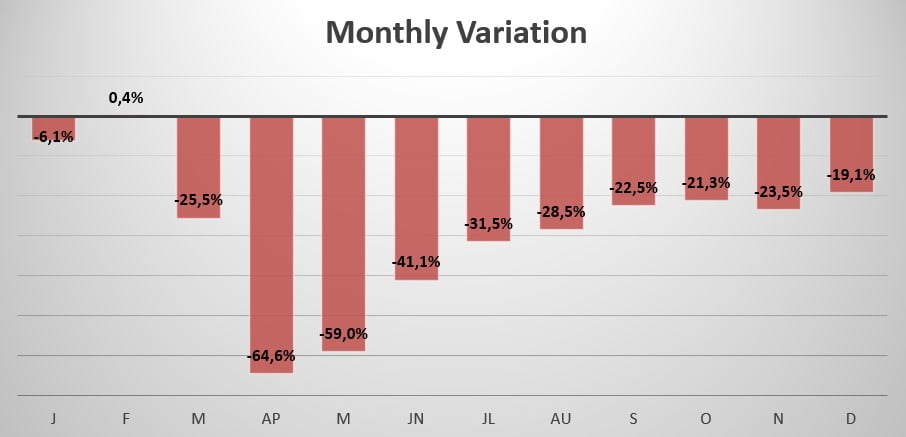

After starting the year with a slight negative trend (-6.1%) the market registered the only positive month of the year in February (+0.4%). The market collapsed in March as the virus struck, in fact, the sharpest drop in sales this year was in April when sales declined by 64.8%. In the following months, the market remained down in double-digits for the entire rest of the year, recovering very slowly.

Indeed, Full-Year sales for 2020 have been 949.121, reporting a decline of 28% compared to 2019.

Brand-wise, this year the leader Nissan (-27.5%) gained 0.2% market share, followed by Chevrolet (-29.9%), which lost 0.4% share. Volkswagen on the other hand lost 0.4% share, falling 30.6%. Toyota remained in 4th place and reported a loss of 27.5%, followed by Kia which lost 22.9%.

Honda lost 34.3%, followed by Mazda (-23.2%) and Ford which reported the worst performance on the leaderboard by losing 35.4%. Closing the leaderboard we have Hyundai losing 29.3% this year and Suzuki entering the leaderboard by jumping 1 spot and reporting the top 20 hold, losing 16.8%.

The most sold vehicle this year remains the Nissan Versa (-21.9%) with 68.013 units sold, followed by the Nissan NP300, which lost 29.2% registering 44.577 new sales this year. The Chevrolet Beat (-40.4%) closes the podium and reports 38.393 new units sold.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 models.