Thailand vehicle market in 2020 increases decreases sales by 25.9% as the pandemic and restrictions affect the entire world. Full-Year sales have been 771.141, while MG was the only brand on the leaderboard to report growth (+6.5%).

Market Trend

The Thailand vehicles market was hit harshly in 2020 as the global pandemic has impacted sales tremendously.

Crucial for the country and producing over 1 million vehicles per year, it started coming out from a really harsh period in 2017.

Indeed a “crazy” government incentive run in 2012 had generated a big bubble of sales with doubling 2012 sales at the record volume of 1.43 million (including HCVs) followed by a fall to a minimum of 768.000 units in 2016, more or less the same level of 2011. Recovery started in 2017 when the market was positively impacted by the possibility, after 5 years of ownership, to re-sell vehicles purchased during the “first car buyers” 2012 incentive campaign.

The market grew 13.4% in 2017 with 871.644 units, holding the impressive pace also in 2018, with sales at 1.041.739 (+19.5%). In 2019, according to data released by the Thai Automotive Industry Association, the market has pushed the breaks, reporting a flat performance with total sales at 1.040.123 (-0.2%).

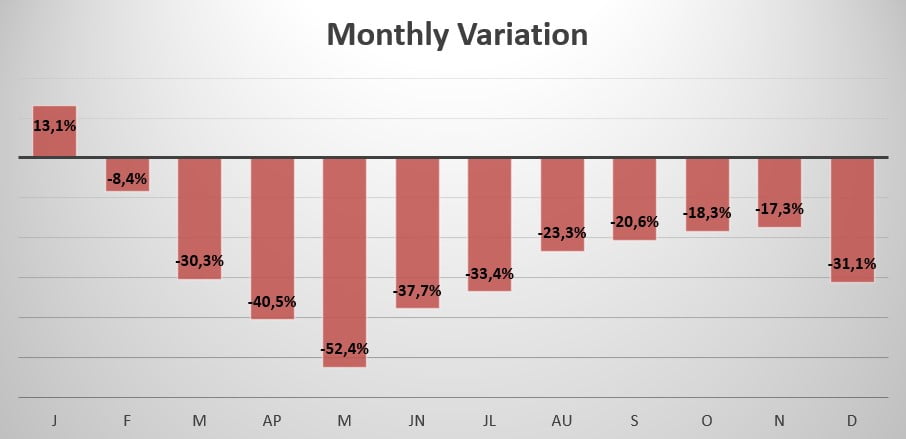

After starting the year with the only positive month (+13.1%), the market quickly collapsed in March as the virus struck. The sharpest drop in sales this year was in May when sales declined by 52.4%.

In the following months, the market did not recover sufficiently, in fact, the market remained down in double-digits for the rest of the year, ending in December down 31.1%.

Indeed, Full-Year sales for 2020 have been 771.141, reporting a decline of 25.9% compared to 2019.

Brand-wise, this year the leader Toyota (-21.7%) gained 1.8% market share, followed by Isuzu (-17.8%), which gained 1.9% share. Honda gained 0.7% share, falling 21.8%. Mitsubishi remained in 4th place (-36.4%), followed by Nissan -up 2 spots- which fell 31.7%.

Mazda lost 35.7%, followed by Ford -down 2 spots- which registered the worst performance by losing 52.8%, and MG which on the other hand was the only brand to report growth (+6.5%). Closing the leaderboard we have Suzuki losing 9.0% this year and Mercedes entering the leaderboard and losing 17.6%.

The most sold vehicle this year has been the Isuzu D-Max (-4.8%) with 136.450 units sold, overtaking the Toyota Hilux, which lost 14% registering 131.293 new sales this year. The Toyota Yaris (-22.4%) closes the podium by jumping 2 spot and reports 32.840 new units sold.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 Models