Uganda’s Auto market in 2021 drops 15.3% with 1,538 sales, reporting a double-digit drop all year except for Q2. Leader Toyota remains unchallenged, and keeps gaining market share.

Market Trend

Uganda’s car market this year was unable to grow and reported a negative performance all year except for Q2.

In 2017, total vehicle sales have been 2,193 (-8.9%) while in 2018 marginally recovered with 2,231 units sold (+2.1%).

The new vehicle market has hit the record of the decade in 2019 after a tough period. Indeed, the market is still really limited, representing only a marginal quota on the import of vehicles, and there are no signs of Government actions to limit the import of exhaust and obsolete used-vehicles. Additionally, an improved economic environment is not enough to sustain private consumer demand, considering the very low pro capita income. In 2019, they reached a peak of 2,555 units (including HCVs), soaring 14.5% from the previous year, hitting the highest volume of the entire decade.

Due to the COVID-19 Pandemic full-Year sales for 2020 have been 1,815, reporting a decline of 29% compared to 2019.

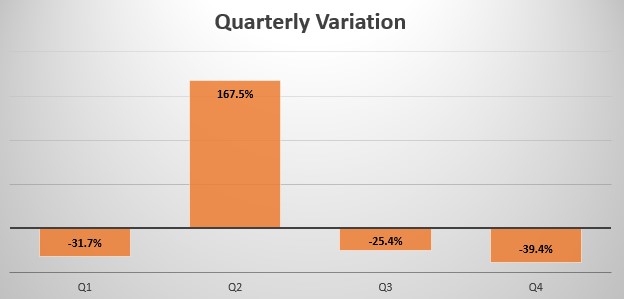

In 2021 the year started very negatively for the Ugandan market, in fact, in Q1 400 units have been sold, reporting a 31.8% decrease in sales compared to Q1 2020, while in Q2 sales started growing again, reporting a 167.2% increase in sales with 420 units sold.

In Q3 sales remained down 25.4% with 362 units sold, and the trend continued in Q4 when sales were down 39.4% with 356 units.

Indeed, Full-Year sales for 2021 have been 1,538, reporting a 15.3% decrease compared to 2020.

Brand-wise, this year the leader Toyota (-1.1%) gained 7.8% market share, followed by Nissan (-26.9%), which lost 2.8% share. Mitsubishi (-35.5%) was in the third position and lost 2% market share.

The most sold model in the country remains the Toyota Hilux with 311 sales (+2.6%), holding 22.8% market share.