Argentinian Auto market in 2021 rises by 16.4% with 394,576 sales, reporting a very strong first half and then remained mostly flat in the second half. Toyota reports the best performance this year and reaches the top of the leaderboard.

Market Trend

The Argentinian car market started the year incredibly positively in the first half, and remained flat in the second half of the year.

In the last decades, the market surfed on waves with sudden falls followed by a sharp recovery. The current record was established in 2013 with 923,000 sales before falling down to 630,000 in 2015 and start the recovery.

Rapid expansion was driven by the implementation of the new National Automotive Plan, sponsored by the Prime Minister, called the One Million Plan, aiming to double sector employment in 5 years of booming export and domestic demand. The election of Macri’s government, while changed the economic policy, gave new expectations and then boost to the sector, which grew both in 2016 and 2017. Indeed, in 2017 the market hit the second-best results ever, with 892,739 sales (+29.8%).

However, in the last three years, the market has been disappointing, as sales dropped 11.5% in 2017, while in 2019 the huge economic crisis hardly hit the new vehicles demand and the market felt down during all the year ending with a final score below the half-million units, with the worst performance in the last 15 years. Sales in 2020 were heavily influenced by the COVID-19 pandemic, impacting all sectors. In fact, 338,945 units have been sold, reporting a decline of 22.7%.

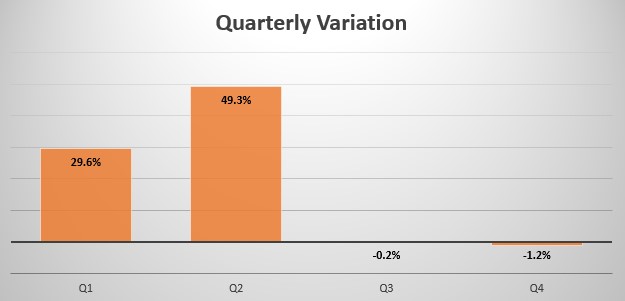

In 2021 the year started positively for the Argentinian market, in fact, in Q1 116,170 units have been sold, reporting a 29.6% increase in sales compared to Q1 2020, and in Q2 sales kept growing, reporting a 49.3% increase in sales with 92,014 units sold.

In Q3 sales remained almost flat, losing 0.2% sales with 95,186 units, and in Q4 sales fell just 1.2% with 91,206 units.

Indeed, Full-Year sales for 2021 have been 394,576, reporting a 16.4% increase compared to 2020.

Brand-wise, this year the new leader Toyota (+70.2%) gained 6.2% market share, overtaking Volkswagen (+2.2%), which lost 2.2% share. Fiat on the other hand reported a very positive performance (+40.3%) with 50,360 units, and gained 2.3% share. Renault fell in 4th place -down 1 spot- (-15.1%), followed by Ford which lost 3.4%.

Chevrolet fell in 6th place and lost 19.2%, followed by Peugeot (+33.3%), and Nissan, which gained 33.8%. Closing the leaderboard we have Citroen gaining 16.9% this year followed by Jeep, which gained 20.6%.

The most sold vehicle this year is the Fiat Cronos which gained 136.4% with 37,435 units sold, overtaking the Toyota Hilux which gained 47.7% registering 27,073 new sales this year. In third place we have the Volkswagen Amrok entering the podium by jumping 2 places and growing 54.2% this year with 18,655 units sold.

Tables with sales figures

In the tables below we report sales for top 10 Brands, top 10 Manufacturers Group.