Brazil auto market in 2020 falls by 26.2% as the country is the 3rd in the world by number of infections. Full-Year sales have been 1.95 Million, while Fiat has impressed by gaining 2.7% and registering the top 10 performance.

Market Trend

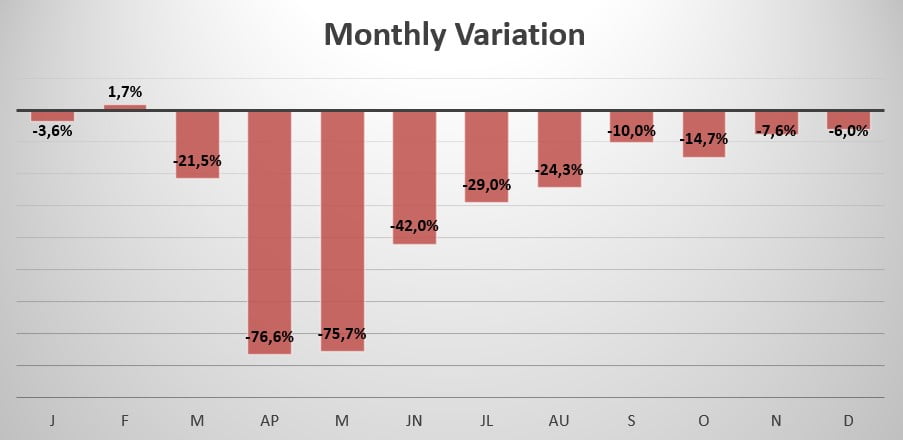

The Brazilian car market was hit extremely harshly in 2020 as the country was the third in the world by number of infections. In fact, during the whole year, February was the only month to report positive sales (+1.7%).

The market in Brazil fell from a record of 3.6 million in 2012, when ranked as 4th globally, below the 2 million in 2016 (1.989.000 units) with a vertical unprecedented and unexpected fall.

The main reason behind the fall was the National Automotive Plan released in 2013 which imposed on the manufacturers’ new standards in terms of contents, safety, emissions further reserving advantages to models locally produced towards the imported from outside the region.

However, the domestic car market bottomed out in the first quarter of 2017 when the volume was over 45% below the 2013 level and a new positive path was approached. After ending 2017 with a recovery of 9.2%, in 2018 and in 2019 the market further improved reaching 2.66 million units.

After starting 2020 with a slight negative trend (-3.6%), the market started collapsing in March as the virus struck. The sharpest drop in sales this year was in April when sales declined by 76.6%, despite Lockdowns starting only in March (-75.7%). The market started recovering in the following months, with performance in December still down 6%.

Indeed, Full-Year sales for 2020 have been 1.954.828, reporting a decline of 26.2% compared to 2019.

Brand-wise, this year the leader Chevrolet (-28.8%) lost 0.6% market share, followed by the growing Volkswagen (-20.4%), which gained an impressive 1.3% share. Fiat on the other hand gained 2.7% share and registered the top 10 performance, falling only 12.1%. Hyundai reached 4th place -up 3 spots- (-19.4%), followed by Ford which lost 36.3%.

Toyota remained in 6th place and lost 36.1%, followed by Renault, which registered the worst performance in the leaderboard (-45%), and Jeep (-14.9%). Closing the leaderboard we have Honda losing 34.8% this year and Nissan losing 36.5%.

The most sold vehicle this year remained the Chevrolet Onix despite falling 43.9% with 135.358 units sold, followed by the Ford Ka, which lost 40% registering 93.282 new sales this year. The Hyundai HB20 (-14.8%) closes the podium and reports 86.550 new units sold. Despite not reaching the podium, only 3k units behind we have the star of the year, the Chevrolet Onix plus, which grew 210.6% this year and reached 4th place.

Tables with sales figures

In the tables below we report sales for all Brands, top 10 Manufacturers Group and top 10 Models.