Egypt’s Auto market in 2021 rises by 21.2% with 266,348 sales, reporting a very strong performance in Q2 and Q3. Renault is the only brand to report significant losses, falling 46.5%.

Market Trend

The Egyptian car market this year recovered effectively from the pandemic crash of 2020 and reported a negative performance only in Q1.

Following two years (2014 and 2015) of high sales volume, in 2016 and 2017, the Egyptian vehicles industry has been buffeted by a devalued currency, spiraling new-vehicle price increases, higher interest rates, and three hikes in fuel prices as the government rolls back fuel subsidies to control budgetary expenditures.

In addition, VAT increased in 2017, and duties for over 2 liters vehicles further increased. The result was an unprecedented fall of demand with 2017 light vehicle sales down at 137,821, losing 36% from the previous year.

Finally, during 2018 the huge pressure on vehicles price has been reduced and the positive economic trend created the mood for recovery. In fact, the market ended the year with 193,000 light vehicle sales. In 2019 the market has been hit again by the price increase and ending the year with a double-digit fall, breaking the recovery. Indeed, Total sales in 2019 have been 171,252, down 11.3%.

Despite the COVID-19 pandemic sales increased in 2020. In fact, sales have been 227,117, reporting an increase of 32.6% compared to 2019.

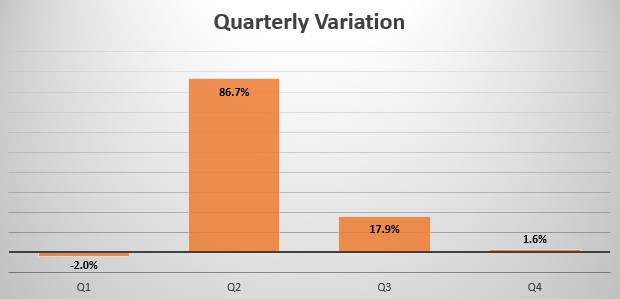

In 2021 the year started slightly negatively for the Egyptian market, in fact, in Q1 50,800 units have been sold, reporting a 2% decrease in sales compared to Q1 2020, while in Q2 sales started growing quickly, reporting a 86.7% increase in sales with 77,589 units sold due to the incredibly low sales volume registered in Q2 2020.

In Q3 sales kept growing, gaining 17.9% sales with 68,364 units, while in Q4 sales rose only 1.6% with 68,364 units sold.

Indeed, Full-Year sales for 2021 have been 266,348, reporting a 21.2% increase compared to 2020.

Brand-wise, this year the leader Chevrolet (+27.3%) gained 1.2% market share, followed by Toyota (+55.9%), which gained 3.6% share and reported the best performance on the leaderboard. Hyundai -up 1 spot- gained 0.4% share, gaining 24.4%. Nissan fell in 4th place (+12.7%), followed by Fiat -up 1 spot- which gained 19.5%.

Kia -up 1 spot- grew 31.3%, followed by Chery which gained 29.7% and Peugeot which rose 2 spots and gained 38.1% sales. Closing the leaderboard we have Opel gaining 12.5% and Renault -down 5 spot- which reported the worst performance, dropping 46.5%.

The most sold vehicle this year has been the Chevrolet TFR (+49.2%) with 30,895 units sold, followed by the Toyota Corolla, which gained 39.5% registering 19,448 new sales this year. The Fiat Tipo (+25%) closes the podium and reports 15,658 new units sold.

Tables with sales figures

In the tables below we report sales for the top 10 Brands and top 10 Models.