Syrian auto market in 2020 crashes 64.8% as the pandemic, social and political instability affect sales tremendously. Full-Year sales have been 2.941, while the market has lost over 96% sales in a decade.

Market Trend

The Syrian car market has been severely hit in 2020 by the world-wide COVID-19 pandemic and by social and political instability within the country.

Not long ago Syria was the biggest car market in the Levant region. Only 10 years ago, with a volume of 87.500 annual sales, the Syrian new market represented a relevant reality within the region. Unfortunately, in this decade the country was destroyed by the civil war and terrorism and the entire economic structure collapsed, including the automotive industry.

Between 2010 and 2013 the market has lost more than half its sales a single year, with 2014 volumes at 23.955 units. The fall continued and the negative peak was hit in 2017 when the market lost 90% from 2010 at 7.978 units. In 2018 sales marginally recovered at near 10.000 units, but the data on 2019 was down again. In fact, total sales in 2019 were 8.347, down 15.8%.

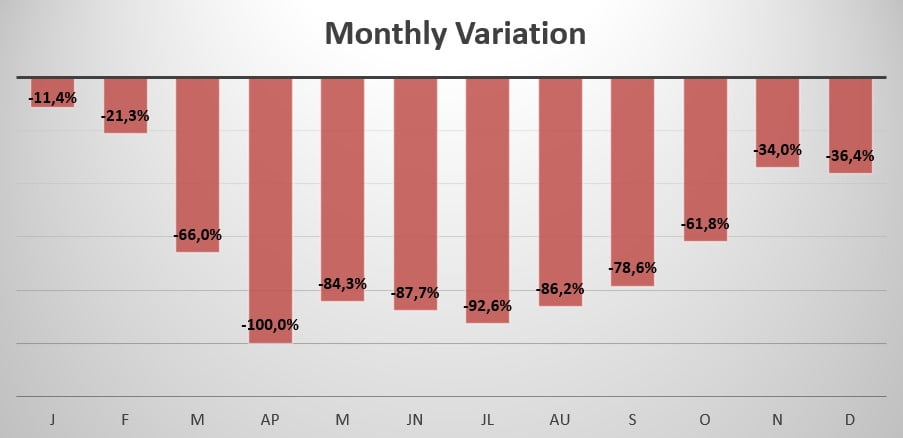

After starting the year with a slight negative trend (-11.4%), the market quickly collapsed in March (-66%) as the virus struck. The sharpest drop in sales this year was in April when no vehicles were sold at all.

In the following months, the market did not recover at all, and sales remained decimated up until Q4 when they were down “only” 34% in November and 36.4% in December.

Indeed, Full-Year sales for 2020 have been 2.941, reporting a decline of 64.8% compared to 2019.

Brand-wise, only 2 brands have sold vehicles in the country: the leader Hyundai fell 63.3% and gained 2.8% share, while Kia lost 68% sales, dropping 2.8% share.

The most sold vehicle this year remains the Hyundai Tucson (-68.2%) with 833 units sold, followed by the Hyundai Elantra (+16%) -up 3 spots- registering 770 new sales this year. The Kia Cerato sedan (-55.2%) closes the podium and reports 304 new units sold.